MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 24th February, 2025

No. 17/2025

G.S.R. 145(E).—In exercise of the powers conferred by sub-section (1A) of

section 115AD, sub-section (4) of section 115TCA, sub-section (4) of section 115UA and

sub-section (7) of section 115UB read with section 295 of the Income-tax Act, 1961 (43 of

1961), the Central Board of Direct Taxes hereby makes the following rules further to

amend the Income-tax Rules, 1962, namely:─

- (1) These rules may be called the Income-tax (Fifth Amendment) Rules, 2025.

(2) They shall come into force on the date of their publication in the Official Gazette. - In the Income-tax Rules, 1962,–

(a) for rule 12CA, the following shall be substituted, namely:-

“12CA. Statement under sub-section (4) of section 115UA.—(1) The statement

of income distributed by a business trust to its unit holder shall be furnished by the

person responsible for making payment of the income distributed on behalf of a

business trust to –

(i) the Principal Commissioner or the Commissioner of Income-tax, as the case

may be, within whose jurisdiction the principal office of the business trust is

situated by the 15th day of June of the financial year following the previous year

during which the income is distributed electronically under digital signature, in

Form No. 64A duly verified by an accountant in the manner indicated therein;

and

(ii) the unit holder by the 30th day of June of the financial year following the

previous year during which the income is distributed in Form No. 64B after

generating and downloading the same from the web portal specified by the

Principal Director General of Income-tax (Systems) or the Director General of

Income-tax (Systems) or the person authorised by him and duly verified by the

person paying the income distributed on behalf of the business trust in the

manner indicated therein.

(2) The Principal Director General of Income-tax (Systems) or the Director General

of Income tax (Systems), as the case may be, shall specify,-

(i) the procedure for filing of Form No. 64A and shall also be responsible for

evolving and implementing appropriate security, archival and retrieval policies

in relation to the statements of income paid so furnished under this rule; and

(ii) the procedure, formats and standards for generation and download of statement

in Form No. 64B from the web portal specified by him or by the person

authorised by him and he shall be responsible for the day-to-day administration

in relation to the generation and download of certificates from the web portal

specified by him or the person authorised by him.”;

(b) for rule 12CC, the following shall be substituted, namely:-

“12CC. Statement under sub-section (4) of section 115TCA.—(1) The statement

of income paid or credited by a securitisation trust to its investor shall be furnished by

the person responsible for crediting or making payment of the income on behalf of a

securitisation trust and the securitisation trust to –

(i) the Principal Commissioner or the Commissioner of Income-tax, as the case

may be, within whose jurisdiction the principal office of the securitisation trust

is situated by the 15th day of June of the financial year following the previous

year during which the income is paid or credited electronically under digital

signature, in Form No. 64E duly verified by an accountant in the manner

indicated therein; and

(ii) the investor by the 30th day of June of the financial year following the previous

year during which the income is paid or credited in Form No. 64F after

generating and downloading the same from the web portal specified by the

Principal Director General of Income-tax (Systems) or the Director General of

Income-tax (Systems) or the person authorised by him and duly verified by the

person paying or crediting the income on behalf of the securitisation trust in the

manner indicated therein.

(2) The Principal Director General of Income-tax (Systems) or the Director General

of Income tax (Systems), as the case may be, shall specify,–

(i) the procedure for filing of Form No. 64E and shall also be responsible for

evolving and implementing appropriate security, archival and retrieval policies

in relation to the statements of income paid or credited so furnished under this

rule; and

(ii) the procedure, formats and standards for generation and download of statement

in Form No. 64F from the web portal specified by him or by the person

authorised by him and he shall be responsible for the day-to-day administration

in relation to the generation and download of certificates from the web portal

specified by him or the person authorised by him.”;

(c) in Appendix-II,–

I. in Form No. 10IH,–

(i) in S.No. 8, the figures “@10%” shall be omitted;

(ii) in S.No. 9, the words and figures “and which is chargeable @10%” shall be

omitted;

(iii) in S.No. 10, the figures “@15%” shall be omitted;

(iv) in Annexure 1,–

(A)in Part A1, the figures “@10%” shall be omitted;

(B) in Part A2, the words and figures “and which is chargeable @10%” shall be

omitted;

(C) in Part A3, the figures “@15%” shall be omitted;

II. for Form No. 64A, Form No. 64B, Form No. 64C, Form No. 64D, Form No.

64E and Form No. 64F, the following shall be substituted, namely:-

“FORM NO. 64A

[See rule 12CA(1)(i)]

[e-Form]

Statement of income distributed by a business trust to be furnished under section 115UA

of the Income-tax Act, 1961

- Name of the business trust

- Address of the registered office

- Permanent Account Number

- Previous year ending

- Name and address of the trustees of the business trust

- Date of registration of the business trust with the Securities and Exchange Board of

India

(i) under the Securities and Exchange Board of India (Real Estate Investment

Trusts) Regulations, 2014

(ii) under the Securities and Exchange Board of India (Infrastructure Investment

Trusts) Regulations, 2014

- Whether the units of the business trust are listed on any recognised stock exchange at

any time during previous year Yes/No - Aggregate income of the Business trust from all sources (9+11+13+15+17)

- Income by way of interest referred to in clause (23FC) of section 10

- Proportion of 9 to 8

- Income by way of renting or leasing or letting referred to in clause (23FCA) of

section 10 - Proportion of 11 to 8

- Income by way of dividend referred to in clause (23FC) of section 10 in a case where

the special purpose vehicle has exercised option under section 115BAA - Proportion of 13 to 8

- Income by way of dividend referred to in clause (23FC) of section 10 in a case where

the special purpose vehicle has not exercised option under section 115BAA - Proportion of 15 to 8

- Income other than that referred to in 9, 11, 13 and 15

- Proportion of 17 to 8

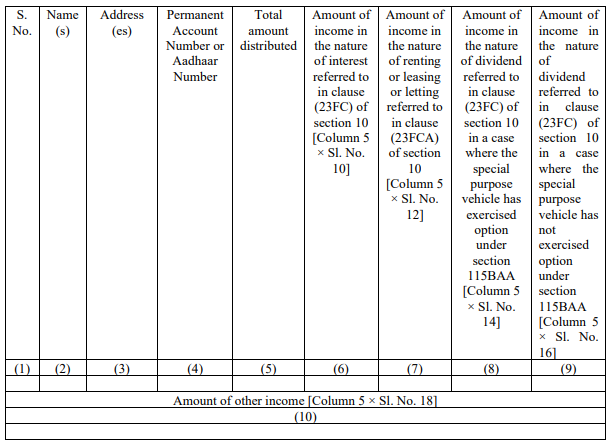

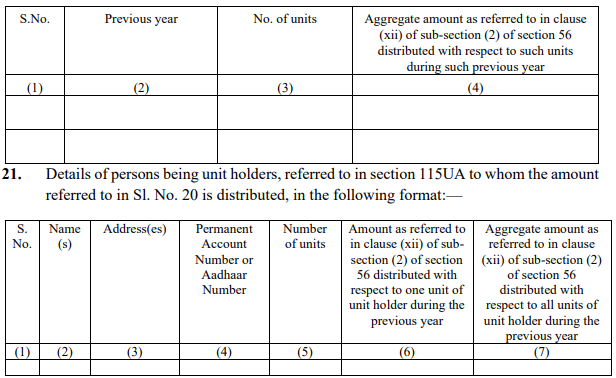

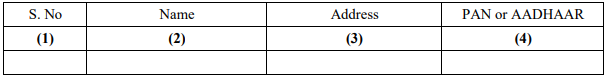

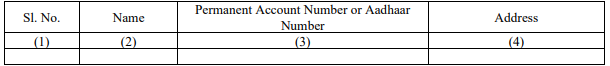

- Details of persons being unit holders, referred to in sub-section (1) of section 115UA

to whom the income is distributed, in the following format:—

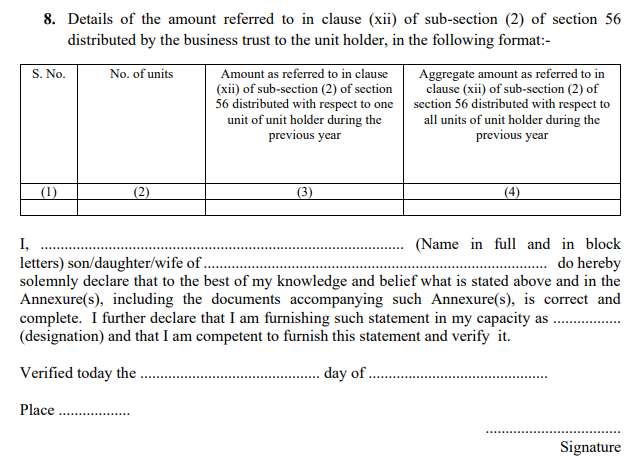

- Amount distributed by the business trust to unit holders with respect to units as referred

to in clause (xii) of sub-section (2) of section 56 during the previous year or during any

earlier previous year(s), in the following format:—

Enclose a copy of the certificate of registration under the Securities and Exchange Board

of India Act, 1992 (15 of 1992).

Enclose a copy of the trust deed registered under the provisions of the Registration Act,

1908 (16 of 1908).

Enclose audited accounts including balance sheet, annual report, if any, with certified

copies of income and appropriation towards distribution of income.

I, ……………………………………………………………………… (Name in full and in block

letters) son/daughter/wife of ……………………………………………………………………… do hereby

solemnly declare that to the best of my knowledge and belief what is stated above and in

the Annexure(s), including the documents accompanying such Annexure(s), is correct and

complete. I further declare that I am furnishing such statement in my capacity as ………….

(designation) and that I am competent to furnish this statement and verify it.

Verified today the ……………………………… day of ………………………………

…………………………….

Place ………………………………… Signature

Verification

I/We* ……………………………………………………………………………………………………… have

examined the books of account and other documents showing the particulars of income

earned and the income distributed to the unit holders by the ………………… (name of the

Business trust) for the previous year ending …………………

- I/We declare that the above particulars are true and correct to the best of my/our

knowledge and belief.

Place …………………………. ………………………………………………………………………….

Date ………………………….. (Signature with name of the Accountant)

Notes: - “Accountant” means the accountant as defined in the Explanation to sub-section (2) of

section 288 of the Income-tax Act, 1961. - *Strike out whichever is not applicable.

FORM NO. 64B

[See rule 12CA(1)(ii)]

[e-Form]

Statement of income distributed by a business trust to be provided to the unit holder

under section 115UA of the Income-tax Act, 1961 - Name of the unit holder

- Address of the unit holder

- Permanent Account Number or Aadhaar Number of the unit holder

- Previous year ending

- Name and address of the business trust

- Permanent Account Number of the business trust

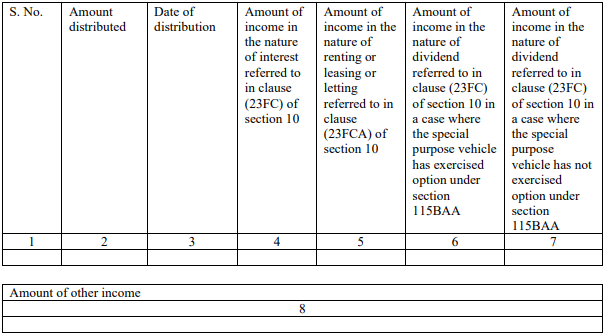

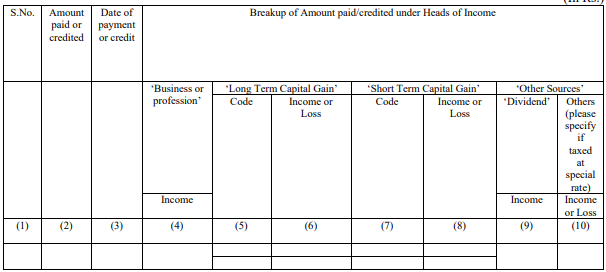

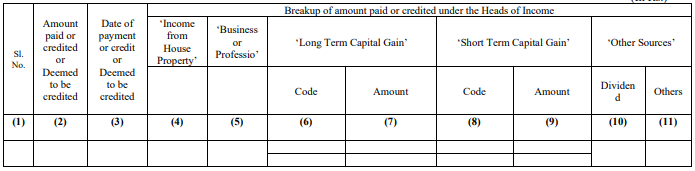

- Details of the income distributed by the business trust to the unit holder, during the

previous year, in the following format:—

FORM NO. 64C

[See clause (i) of sub-rule (1) of rule 12CB )]

[e-Form]

Statement of income distributed by an investment fund to be provided to the unit holder

under section 115UB of the Income-tax Act, 1961

(a) Name of the unit holder:

(b) Address of the unit holder:

(c) Permanent Account Number or AADHAAR of the unit holder:

(d) Previous year ending:

(e) Name and address of the Investment Fund:

(f) Permanent Account Number of the Investment Fund:

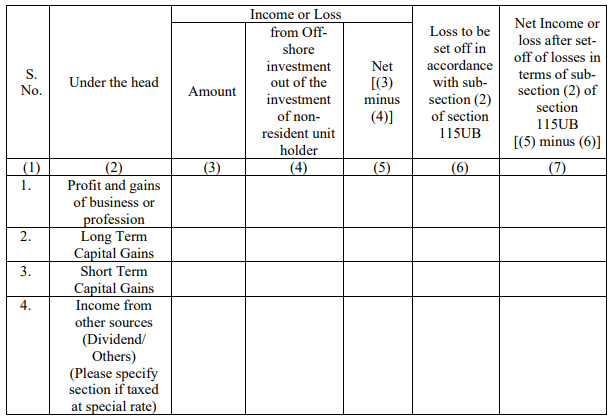

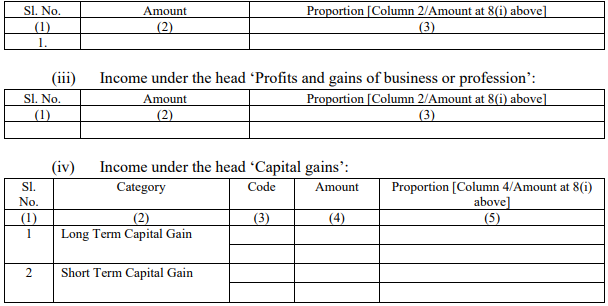

(g) Details of the income or loss [after ignoring the loss under clause (ii) of sub-section (2) of

section 115UB] paid or credited by the Investment Fund to the unit holder during the

previousyear:

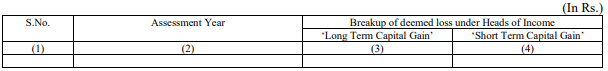

(h) Details of deemed loss as on the 31st March, 2019 in terms of sub-section (2A) of section

115UB (to be passed to the unit holder holding unit on 31st March, 2019)

I,_(Name in full and in block letters) son/ daughter/ wife

of_____________do hereby solemnly declare that to the best of my knowledge and belief

what is stated above and in the Annexure(s), including the documents accompanying such

Annexure(s), is correct and complete. I further declare that I am furnishing such statement in

my capacity as _(designation) and that I am competent to furnish this statement

and verify it.

Verified today the ___________day of________

Place___________________

Signature

Notes:

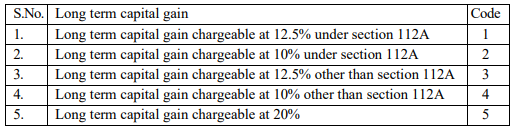

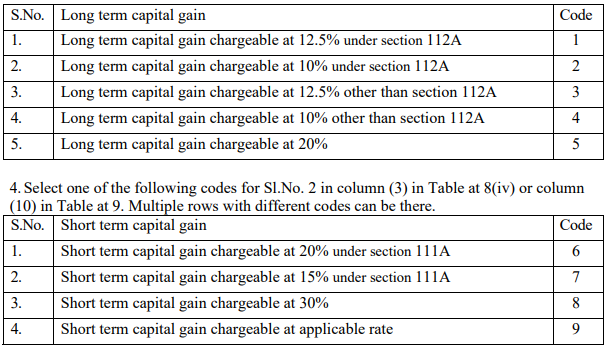

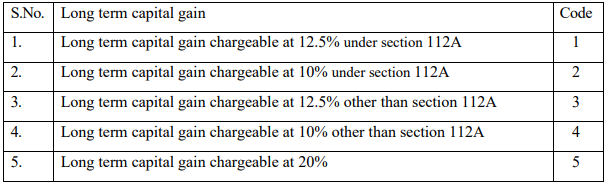

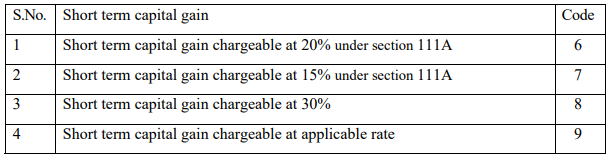

1.Select one of the following codes for column (5) in Table at 7. Multiple rows with different

codes can be there.

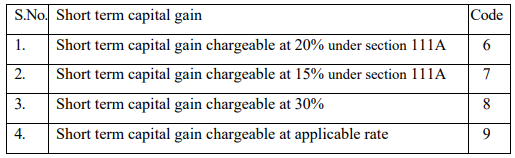

2.Select one of the following codes for column (7) in Table at 7. Multiple rows with different

codes can be there.

FORM NO. 64D

[See clause (ii) of sub-rule (1) of rule 12CB]

[e-Form]

Statement of income paid or credited by investment fund to be furnished under section

115UB of the Income- tax Act, 1961

- Name of the Investment Fund:

- Address of the registered office:

- Legal status company or trust or limited liability partnership or bodycorporate:

- Permanent Account Number:

- Previous year ending:

- Name and address of the Directors or Trustees or Partners of the Investment fund*:

- (i) Whether registered as Alternative Investment Fund with Securities and Exchange

Board of India under the Securities and Exchange Board of India (Alternative Investment

Funds) Regulations, 2012 or the International Financial Services Centres Authority (Fund

Management) Regulations, 2022: Yes/No*

(ii) If yes, furnish following details:

(a) Whether registered as Category I or II : Yes/No

(b) Registration number :

(c) Date of registration : - (a) Total income of Investment Fund during the previous year ………………………

(b) Break-up of total income [aggregate of amounts under column (7) of the following

table for each head]:

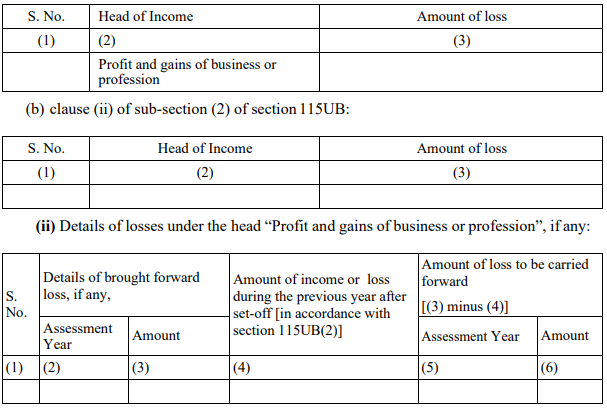

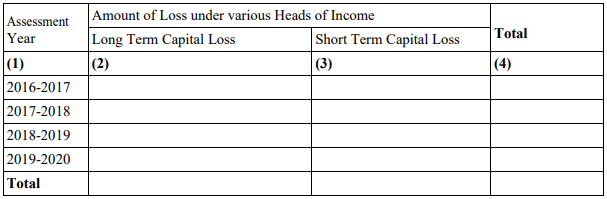

- (i) Details of losses of the previous year, if any; required to be ignored for the purposes

of sub-section (1) of section 115UB in accordance with,-

(a) sub-clause (b) of clause (i) of sub-section (2) of section 115UB:

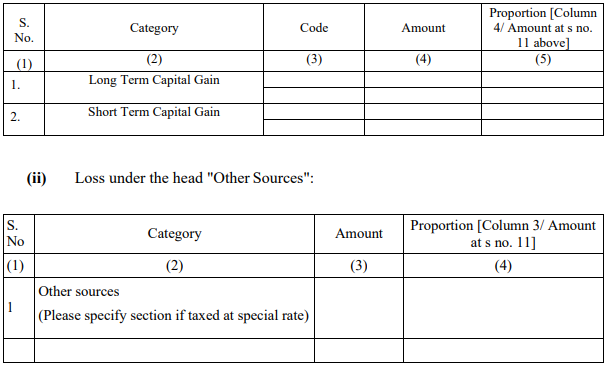

(iii) Aggregate of positive income of the Investment Fund under various heads after setting

off of losses at (ii) above [aggregate of the positive amounts in column (7) of the table under

para 8(b) after set off] :……………..

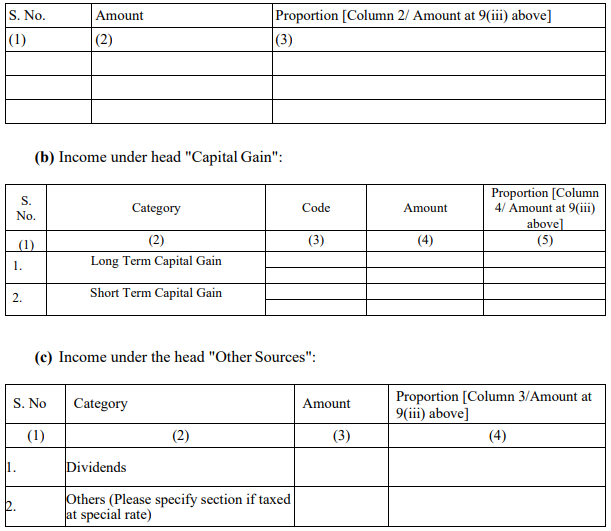

(a) Income under head “Profit and gains of business orprofession”:

- Details of loss other than the loss under the head “Profits and gains of business or

profession”, if any, accumulated at the level of investment fund as on the 31st March, 2019:

- Aggregate of loss under various heads after ignoring the loss in 9(i)(b) above [aggregate

of the negative amounts in column (7) of the table under 8(b)]: ………..

(i) Loss under head “Capital Gain”:

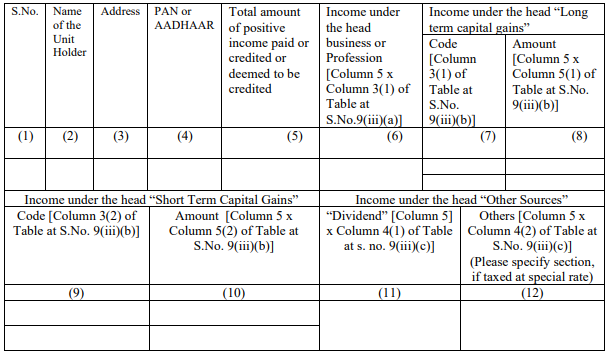

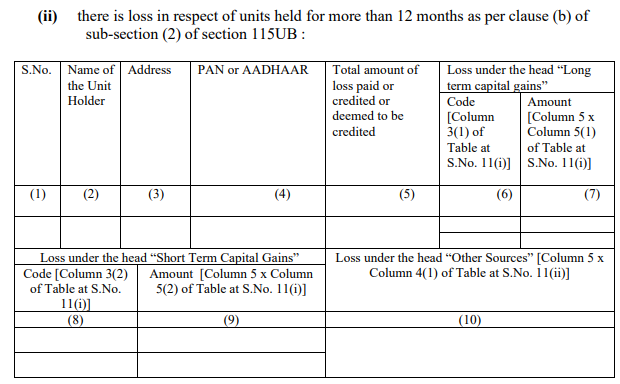

- Details of person being a unit holder, referred to in sub-section (1) of section 115UB by

whom the income or loss is received or in whose name it has been credited in a case where,-

(i) there is positive income:

Attach a copy of the certificate of registration under the Securities and Exchange Board of India

(Alternative Investment Funds) Regulations, 2012 or the International Financial Services Centres

Authority (Fund Management) Regulations, 2022.

Attach audited accounts including balance sheet, annual report, if any, with certified copies of income

and appropriation towards payment of income or credit of income [including amount deemed to have

been credited in accordance with provisions of sub-section (6) of section 115UB].

I, (Name in full and

in block letters) son/daughter/wife of do hereby solemnly

declare that to the best of my knowledge and belief what is stated above and in the

Annexure(s), including the documents accompanying such Annexure(s), is correct and

complete. I further declare that I am furnishing such statement in my capacity as

(designation) and that I am competent to furnish

this statement and verify it.

Verified today the day of .

Place_________________ Signature__________________

Verification

I/We have examined the books

of account and other documents showing the particulars of income earned and the income

paid or credited [including amount deemed to have been credited in accordance with

provisions of sub-section (6) of section 115UB] to the unit holder by the _

(name of the Alternative Investment Fund) for the previous year ending .

- I/We declare that the above particulars are true and correct to the best of my/our

knowledge and belief.

Place

Date (Signature with name of the accountant)

Notes: - “Accountant” shall have the same meaning as assigned to it in the Explanation below subsection (2) of section 288 of the Income-tax Act, 1961.

- All amount to be mentioned in Indian rupees.

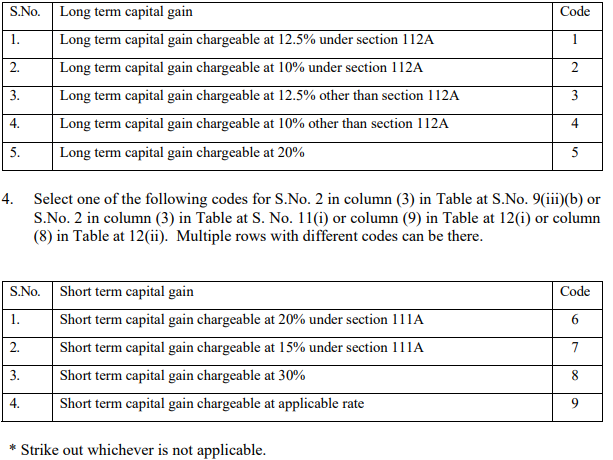

- Select one of the following codes for S.No. 1 in column (3) in Table at S.No. 9(iii)(b) or

S.No. 1 in column (3) in Table at S. No. 11(i) or column (7) in Table at 12(i) or column

(6) in Table at 12(ii). Multiple rows with different codes can be there.

FORM NO. 64E

[See rule 12CC(1)(i)]

[e-Form]

Statement of income paid or credited by a securitisation trust to be furnished under

section 115TCA of the Income-tax Act, 1961

- Name of the securitisation trust:

- Address of the registered office:

- Legal status:

- Permanent Account Number:

- Previous year ending:

- Name and address of the Trustees or Directors or Partners of the securitisation trust:

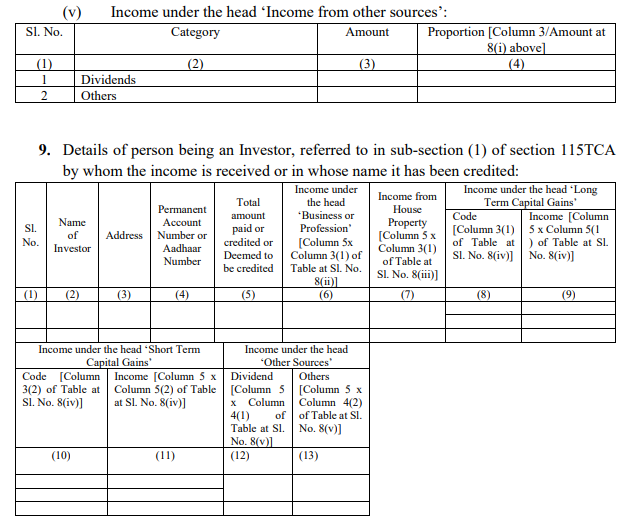

- (i) Status of Securitisation Trust:

(please mention applicable sub-clause of the clause (d) of the Explanation below

section 115TCA)

(ii) Registration number:

(Please also indicate Act or Regulation under which registered)

(iii) Date of registration: - Details of income of Securitisation Trust:

(i) Total income of securitisation trust (in Rs.):

(ii) Income under the head ‘Income from house property’:

Attach a copy of the certificate of registration under the applicable Act or Regulations, viz.,

in case of securitisation trust, under the Securities and Exchange Board of India (Public Offer

and Listing of Securities Debt Instruments) Regulations, 2008; in case of Special Purpose

Vehicle regulated by the guidelines of Standard Assets issued by the Reserve Bank of India;

and in case of Securitisation Company or a Reconstruction Company, under the Securitisation

and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

Attach audited accounts including balance sheet, annual report, if any, with certified copies

of income and appropriation towards payment of income or credit of income [including

amount deemed to have been credited in accordance with provisions of sub-section (3) of

section 115TCA].

I, …………………………………………………………………………….(Name in full and

in block letters) son/daughter* of ……………………………………………do hereby

solemnly declare that to the best of my knowledge and belief what is stated above and in the

Annexure(s), including the documents accompanying such Annexure(s), are correct and

complete. I further declare that I am furnishing such statement in my capacity as

……………………………………………………………………………..(designation) and

that I am competent to furnish this statement and verify it.

Verified today ……………………….. the day of ……………………………

Place ………………………. Signature ………………

Verification

I/We*……………………………………………………………………………………have

examined the books of account and other documents showing the particulars of income earned

and the income paid or credited [including amount deemed to have been credited in

accordance with provisions of sub-section (3) of section 115TCA] to the investor by the

…………………………………………(name of the Securitisation Trust) for the previous

year ending…………………………….

- I/We* declare that the above particulars are true and correct to the best of my/our

knowledge and belief.

…………………………………………..

Place ……………… (Signature with name of the Accountant)

Membership No. ………………………

Date ……………….

Notes: - “Accountant” means the accountant as defined in the Explanation below sub-section (2)

of section 288 of the Income-tax Act, 1961.

2.All amount to be mentioned in Indian Rupees.

3.Select one of the following codes for Sl.No. 1 in column (3) in Table at 8(iv) or column

(8) in Table at 9. Multiple rows with different codes can be there.

*Strike out whichever is not applicable.

FORM NO. 64F

[See rule 12CC(1)(ii)]

[e-Form]

Statement of income distributed by a securitisation trust to be provided to the investor

under section 115TCA of the Income-tax Act, 1961

- Name of the investor:

- Address of the investor:

- Permanent Account Number or Aadhaar Number of the investor:

- Previous year ending:

- Name and address of the securitisation trust:

- Permanent Account Number of the securitisation trust:

- Details of the income paid or credited by the securitisation trust to the investor during

the previous year:

I, _______________________ (Name in full and in block letters) son/daughter*

of _______________ do hereby solemnly declare that to the best of my

knowledge and belief what is stated above and in the Annexure(s), including the documents

accompanying such Annexure(s), is correct and complete. I further declare that I am furnishing

such statement in my capacity as ____ (designation)

Verified today the __ day of

Place _________

Signature

Notes:

1.Select one of the following codes for column (6) in Table at 8. Multiple rows with different

codes can be there.

2.Select one of the following codes for column (8) in Table at 8. Multiple rows with different

codes can be there.

*Strike out whichever is not applicable.”.

[F. No. 370142/28/2024-TPL]

SOURABH JAIN, Under Secy.

Note. – Principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3,

Sub section (ii) vide notification number S.O. 969(E), dated the 26th March, 1962 and was last

amended vide notification number G.S.R. 125(E), dated the 07th February, 2025.