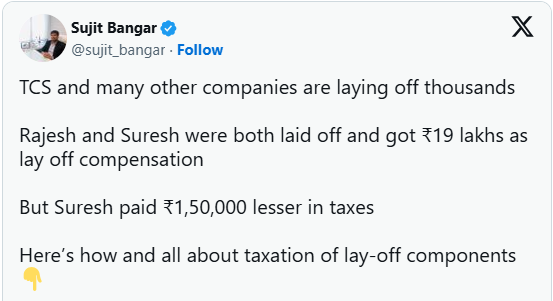

Voluntary retirement isn’t just a career move—it’s a massive tax game. Choosing the Voluntary Retirement Scheme (VRS) route over a standard severance package can leave you significantly richer, thanks to a key tax exemption.

Thank you for reading this post, don't forget to subscribe!Here’s the essential breakdown, based on the insights from Sujit Bangar, founder of TaxBuddy.com.

🎯 The Core Advantage: Section 10(10C)

The secret to maximizing your payout lies in Section 10(10C) of the Income Tax Act.

This section grants an exemption of up to ₹5 Lakhs on a VRS payout. Standard severance does not qualify for this benefit.

| Scenario | Payout Type | Total Lumpsum Received | Tax Exemption (Sec 10(10C)) | Taxable Income (Approx.) | Base Tax (Approx.) |

| Rajesh (Severance) | Severance + Notice Pay | ₹19 Lakhs (₹15L + ₹4L) | ₹0 | ₹19 Lakhs | ₹5.7 Lakhs |

| Suresh (VRS) | VRS | ₹15 Lakhs | ₹5 Lakhs | ₹14 Lakhs | ₹4.2 Lakhs |

The result: Suresh (VRS) saves approximately ₹1.5 Lakhs on base tax compared to Rajesh (Severance) on the same payout amount.

⚖️ The Critical Choice: 10(10C) vs. 89(1) Relief

If you receive a large lumpsum payment, you have two primary tax options for that amount, but you must pick one:

- Section 10(10C) Exemption: Use this for VRS payouts to exempt up to ₹5 Lakhs.

- Section 89(1) Relief: This is an option for one-time lumpsums (like large severance or arrears) that allows you to smooth out the tax burden by spreading the income across previous years.

🚨 WARNING: You cannot claim the Section 10(10C) exemption and the Section 89(1) relief on the same payout.

- Mandatory Step for 89(1) Relief: You must file Form 10E to claim Section 89(1) relief.

✅ Your Essential Paperwork Checklist

Don’t let tax savings vanish due to poor documentation. Follow this checklist:

- HR Breakup Letter: Get a clear letter from HR detailing the exact breakup of the payment: Notice Pay vs. Severance/VRS Compensation.

- Verification: Cross-check the amounts in your Form 16 against your Form 26AS/AIS.

- VRS Claimers: Retain a copy of the VRS scheme and the essential Rule 2BA compliance certificate.

🎁 Don’t Forget Other Exemptions

Leaving a job often unlocks other valuable tax exemptions that must be claimed separately:

- Gratuity (Section 10(10)): Exempt up to ₹20 Lakhs.

- Leave Encashment (Non-Govt.): Exempt up to ₹25 Lakhs.

- Retrenchment Compensation (Sec 10(10B)): Exempt up to ₹5 Lakhs, but this applies only to non-voluntary retrenchment that meets the Industrial Disputes Act conditions.

In Summary: When leaving your company, explore the VRS route first. The ₹5 Lakh tax-free limit under Section 10(10C) is often the simplest and most rewarding way to maximize your goodbye check.