Tesla’s India Debut Spotlights India’s Steep Car Taxes, Sparking Public Outcry

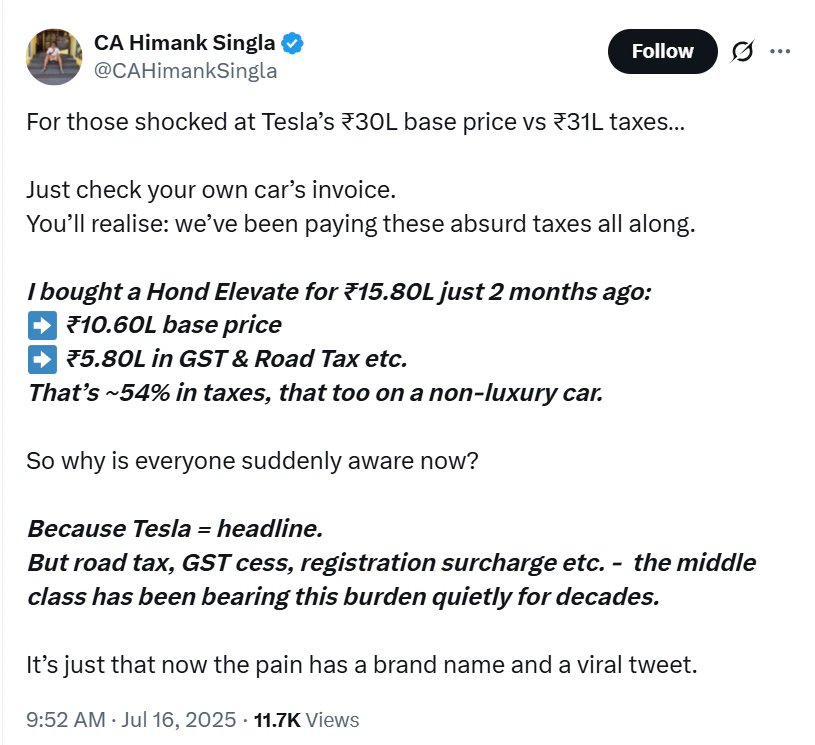

Thank you for reading this post, don't forget to subscribe!The recent launch of Tesla cars in India has thrown a stark spotlight on the nation’s “absurd” automotive taxation, triggering widespread concern among consumers. A chartered accountant pointed out that while the focus is currently on the hefty ₹31 lakh tax on a ₹30 lakh base price for a Tesla, Indians have been silently bearing the burden of similarly high taxes on all cars, even non-luxury models, for years.

The Tesla Tax Shock: A Case Study

Tesla debuted its Model Y variants in India at ₹59.89 lakh (Rear-Wheel Drive) and ₹67.89 lakh (Long-Range Rear-Wheel Drive). In stark contrast, the same Model Y starts at approximately $44,990 (over ₹38 lakh) in the US, $36,700 (₹31.5 lakh) in China, and $53,700 (₹46 lakh) in Germany. This significant price disparity is largely due to India’s 70% import duty on fully built cars priced below $40,000, and up to 100% on those above $40,000. Elon Musk has previously termed India’s import duties “among the highest in the world.”

Netizens quickly expressed their dismay, with one user noting, “Tesla is selling the car at almost same price in India, but it is Tax in India which is making it expensive here.” Another lamented, “We are a poor nation. Here everything is a luxury. Air conditioners are taxed at 28%!”

Why the High Taxes?

The primary driver behind these exorbitant prices is India’s protectionist policy aimed at boosting local manufacturing. The government seeks to encourage foreign automakers to set up production facilities within the country, offering concessions on import duties to those who commit to local investment and production. Tesla, for now, is opting to import its cars, likely from its China gigafactory, to “test the waters” in the Indian market rather than immediately committing to local manufacturing.

Tesla’s Chief Financial Officer, Vaibhav Taneja, had previously acknowledged that India’s 70% tariff on EV imports, coupled with additional “luxury taxes” (referring to the overall high tax burden on premium imported vehicles), creates “price anxiety” for customers.

Beyond Tesla: The Broader Tax Landscape in India

The chartered accountant’s call for Indians to re-examine their own car invoices underscores a pervasive issue. Even for locally manufactured vehicles, Indians pay substantial taxes:

- GST: Most cars attract a 28% Goods and Services Tax.

- Compensation Cess: An additional compensation cess is levied, varying based on factors like vehicle length, engine capacity, fuel type, and body style. This can push the total effective tax rate for non-EVs as high as 48-50%.

- Electric Vehicles (EVs): While EVs enjoy a lower 5% GST, this benefit is largely negated for imported units due to the high import duties.

- State-Specific Taxes: States also impose road tax and registration charges, further adding to the on-road price. For instance, Maharashtra recently increased its one-time registration tax for luxury cars above ₹20 lakh, potentially adding over ₹10 lakh to their cost.

Ultimately, India’s complex and high tax structure on automobiles serves to protect its domestic industry and generate revenue, but it also makes vehicle ownership, particularly for imported premium brands like Tesla, significantly more expensive for the average Indian consumer.