As Diwali approaches, the festive bonuses and gifts from your employer might bring joy, but they could also bring a surprise tax bill. Under India’s income tax laws, most festive rewards are not tax-free.

Thank you for reading this post, don't forget to subscribe!Here’s how the tax department views the goodies you receive:

https://whatsapp.com/channel/0029Vb6RIk18kyyUdnBfGH27

1. Cash Bonus is Fully Taxable as Salary

Any cash payment received as a Diwali bonus is treated as part of your salary income under Section 17(1) of the Income Tax Act.

- Tax Rule: It is fully taxable according to your income tax slab.

- Action: Your employer must deduct TDS (Tax Deducted at Source) on the bonus amount.

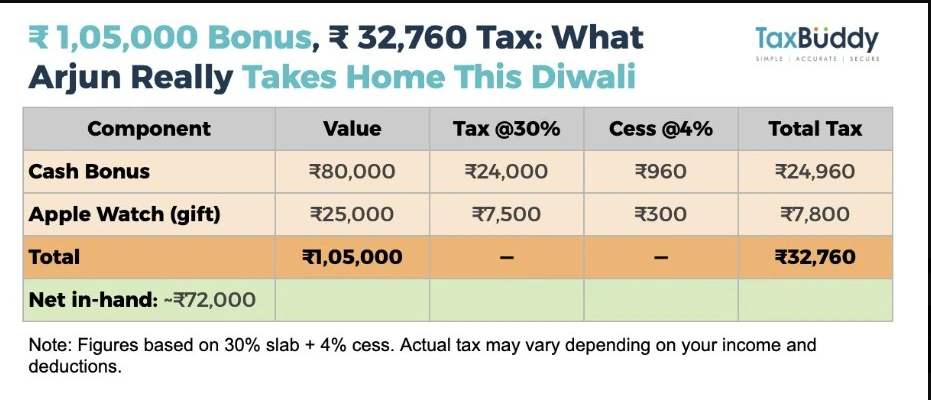

Example: The ₹80,000 Bonus A corporate employee, Arjun, received an ₹80,000 cash bonus. Since this fell into his 30% tax slab, it cost him ₹24,960 in taxes (including cess).

2. Non-Cash Gifts are Taxable as Perquisites

Non-cash gifts, such as gadgets, vouchers, or hampers, are considered perquisites under Section 17(2)(viii).

- Exemption: Gifts up to ₹5,000 in a financial year are tax-exempt.

- Tax Rule: If the total value of non-cash gifts exceeds ₹5,000, the entire value of the gift becomes taxable as salary, not just the excess amount.

This rule applies to:

- Electronics or gadgets

- Gift vouchers and coupons

- Paid holidays or travel packages

- Festival hampers (if value is over ₹5,000)

Example: The ₹25,000 Apple Watch Arjun’s Apple Watch, valued at ₹25,000, was fully taxable because it crossed the ₹5,000 threshold. This added another ₹7,800 to his tax bill.

https://whatsapp.com/channel/0029Vb6RIk18kyyUdnBfGH27

Total Tax Impact: The Festive Windfall Cost

Arjun’s total tax hit from his Diwali package was ₹32,760 (₹24,960 for the bonus + ₹7,800 for the gift).

GST Implications for the Employer

Companies also need to be careful. If an employer gives gifts worth more than ₹50,000 per employee per year, it attracts GST. The company also cannot claim Input Tax Credit (ITC) on those gifts.

General Gift Tax (Gifts from Others)

While employer gifts are taxed as salary, gifts from non-employers are taxed differently:

- General Rule: Gifts received by an individual or family are tax-exempt up to ₹50,000 per financial year. If the total exceeds this limit, the entire amount is taxable as “Income from Other Sources.”

- Exemption: Gifts from defined relatives (like parents or siblings) are fully exempt, regardless of value.

Avoiding Festive Tax Shocks

To ensure you don’t overpay the taxman, experts advise employees to:

- Verify that your Form 16 correctly reports both bonuses and gifts.

- Confirm that TDS has been accurately deducted by your employer.

- Keep invoices and proof of gifts handy in case the Income Tax Department has questions.

This Diwali, remember that while the Gift Tax Act was scrapped years ago, the taxation of employer bonuses and gifts is still active. Celebrate your rewards, but keep the tax rules in mind!