A significant “glitch” in the Income Tax Return (ITR) utility for Financial Year (FY) 2024–25 is causing concern among salaried taxpayers regarding their House Rent Allowance (HRA) claims. Chartered Accountant Himank Singla has warned that the ITR portal incorrectly prompts users to enter their “Place of Work” instead of their “Place of Residence” for HRA exemption calculation under Section 10(13A).

Thank you for reading this post, don't forget to subscribe!

Key Issues and Implications:

- Incorrect City Selection: The Income Tax Act bases HRA exemption on the taxpayer’s residential city (50% of salary for metro cities, 40% for non-metro cities). The ITR utility’s prompt for “Place of Work” directly contradicts this rule.

- Over/Underclaiming HRA: This flaw could lead to taxpayers either claiming more HRA than they are eligible for (if they work in a metro city but reside in a non-metro) or less (if they reside in a metro city but work in a non-metro).

- Compliance Risks: Such discrepancies may trigger scrutiny from the Income Tax Department or result in defective return notices, requiring taxpayers to justify their claims.

- Urgent Rectification Needed: Singla has urged the Income Tax Department to fix this issue immediately to prevent widespread filing errors as the deadline for ITR filing approaches. He advises taxpayers to manually override the portal’s suggestion and calculate their exemption based on their actual residence until the utility is corrected.

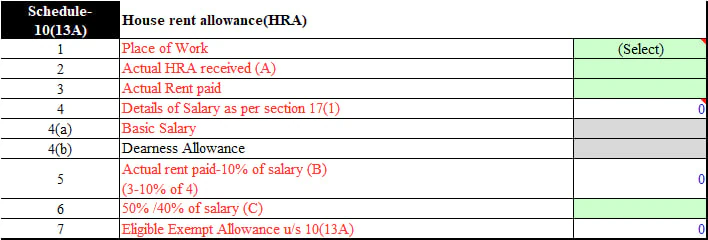

Understanding HRA Exemption under Section 10(13A):

HRA is a component of a salaried employee’s income designed to help cover rental expenses. It is generally taxable, but partial or full exemption can be claimed under Section 10(13A) under the old tax regime only. No HRA exemption is allowed if:

- The taxpayer lives in their own house.

- The taxpayer opts for the new tax regime.

Calculation of Exempt HRA:

The exempt amount is the least of the following three:

- Actual HRA received.

- 50% of salary (for metro cities: Delhi, Mumbai, Kolkata, Chennai) or 40% of salary (for non-metro cities).

- Rent paid minus 10% of salary.

- Salary for HRA purposes: Includes basic pay, dearness allowance (if it forms part of retirement benefits), and commission (if based on turnover).

Conditions for Claiming HRA Exemption:

- Must be a salaried individual receiving HRA.

- Must live in rented accommodation.

- Must maintain valid rent receipts and proof of rent payments.

- If annual rent exceeds Rs 1 lakh, the landlord’s PAN is mandatory. If the landlord does not have a PAN, a self-declaration from the landlord stating this, along with their name and address, is required as per CBDT Circular No. 8/2013 dated October 10, 2013.

Documents Required (for employer verification and departmental inquiries, not for filing with ITR):

- Rent receipts for the applicable financial year.

- Rental agreement as proof of tenancy.

- Form 12BB (to declare HRA claim to employer).

- Bank statement or payment proof showing rent transfers.

- Salary slip reflecting the HRA component.

- Landlord’s PAN (if annual rent exceeds Rs 1 lakh), or a self-declaration if the landlord doesn’t have a PAN.

Current Status of the Glitch:

While the Income Tax Department’s e-filing portal has undergone updates and various common issues have been addressed, there is no official confirmation yet regarding the specific “Place of Work” vs. “Place of Residence” glitch for HRA calculation in the FY 2024-25 ITR utility. Taxpayers are advised to exercise caution and follow the guidance of tax experts like CA Himank Singla, who recommend manually calculating and overriding the portal’s suggestion if it presents the incorrect prompt.

For assistance with ITR utility issues, taxpayers can contact the Income Tax Department’s e-filing and Centralized Processing Center helpdesks at:

- Toll-free numbers: 1800 103 0025, 1800 419 0025

- Helpline numbers: +91-80-46122000, +91-80-61464700

- Email: ITR.helpdesk@incometax.gov.in

Dive into the epic realm of EVE Online. Start your journey today. Explore alongside millions of pilots worldwide. Play for free

The Full List of Trusted Darknet Markets

Pitch darknet forum

https://pitch-darknet.com

Best darknet markets

Pitch Forum

https://pitch-darknet-market.net

Top darknet markets 2025

Pitch Forum Links

https://pitch-darknet.com

The Full List of Trusted Darknet Markets

drughub darknet market

https://drughub-marketplace-darknet.com

Best darknet markets

drughub darknet market

https://market.drughub-darknet.net

Top darknet markets 2025

drughub darknet

https://drughub-market-darknet.com

[url=https://okna-plastic-6.ru/]https://okna-plastic-6.ru/[/url] – купить окна в Москве с примеркой по размерам с установкой деревянных окон на теплые с бонусами

The Full List of Trusted Darknet Markets

darknet guide

https://darknet-forum.net

Best darknet markets

darknet guide

https://deepweb-access.net

Top darknet markets 2025

darknet shop list

https://deepweb-guides.net

https://www.okna-plastic-10.ru/ – фото работ портфолио топ производителей сертификаты партнеры надежная компания

https://okna-plastic-7.ru/ – заказать окна в регионе с консультацией по фото с установкой старых окон на современные с кэшбэком

http://okna-plastic-1.ru – лоджии под ключ с обшивкой вагонкой с выключателями с полками евростандарт

окна в рассрочку – удобная рассрочка платежа на остекление с первым взносом

https://okna-plastic-9.ru – прямые поставки без наценок собственное производство сертификаты установка за 1 день

https://www.okna-plastic-8.ru/ – реальные отзывы портфолио лучшие в Москве разрешения партнеры опыт работы

http://www.okna-plastic-2.ru – окна цены бесплатно с учетом установки честные акционные по рекомендации с отсрочкой

http://okna-plastic-5.ru/ – пластиковые окна Москва во всех округах бесплатный замер инженер-замерщик в удобное время

пластиковые окна рехау – надежные оконные системы Рехау с установкой

https://www.okna-plastic-7.ru/ – фото работ выполненные объекты лучшие в Москве сертификаты партнеры опыт работы

http://okna-plastic-3.ru – балконы под ключ с утеплением вагонкой с розетками с шкафами евростандарт

окна пластиковые недорого в москве цены от производителя с установкой – бюджетные пластиковые окна в Москве от производителя по низким ценам

https://okna-plastic-8.ru – заводские цены без переплат европейское оборудование гарантия 5 лет изготовление за 1 день

https://www.okna-plastic-4.ru – окна ПВХ в Московской области от производителя со скидкой в кредит качественные европейского качества KBE трехкамерные энергосберегающие

okna-plastic-1.ru – балконы под ключ холодное полное по области с отделкой качественно с материалами евроремонт

okna-plastic-10.ru – балконы под ключ теплое частичное с выездом с утеплением недорого с гарантией евроремонт

http://www.okna-plastic-7.ru – ПВХ конструкции для квартиры с монтажом по специальной цене белые нестандартные глухие с подоконниками

https://www.okna-plastic-5.ru/ – фото работ выполненные объекты топ производителей разрешения производители надежная компания

https://www.okna-plastic-2.ru – металлопластиковые окна в Москве под ключ недорого с рассрочкой надежные европейского качества Veka трехкамерные противовзломные

https://okna-plastic-9.ru – заводские цены без посредников собственное производство гарантия 5 лет установка за 1 день

окна кбе купить – теплые окна KBE с установкой с гарантией

okna-plastic-6.ru – балконы под ключ теплое панорамное по области с отделкой недорого с гарантией эконом

okna-plastic-3.ru – остекление лоджий алюминиевое панорамное с выездом с утеплением недорого с работой премиум

https://okna-plastic-10.ru/ – заказать окна в регионе с консультацией по фото с ремонтом советских окон на пластиковые с выгодой

остеклить дом – частичное остекление дома под ключ

https://okna-plastic-4.ru – заводские цены без наценок немецкие технологии сертификаты установка за 1 день

okna-plastic-1.ru – остекление лоджий алюминиевое полное с выездом с освещением качественно с материалами премиум

http://www.okna-plastic-9.ru – окна цены с калькулятором с учетом комплектации прозрачные акционные для новых клиентов в кредит

[url=https://okna-plastic-8.ru/]https://www.okna-plastic-8.ru/[/url] – фото работ наши работы лучшие в Москве сертификаты поставщики надежная компания

[url=https://okna-plastic-2.ru/]установка пластиковых окон[/url] – качественная монтаж оконных систем в Москве

[url=https://okna-plastic-5.ru/]okna-plastic-5.ru[/url] – остекление лоджий теплое частичное с выездом с утеплением быстро с гарантией премиум

[url=https://okna-plastic-10.ru/]okna-plastic-10.ru/[/url] – рехау окна сертифицированные золотой дуб с мультифункциональным стеклом с детским замком с москитной сеткой

[url=https://okna-plastic-7.ru/]www.okna-plastic-7.ru[/url] – ПВХ конструкции для дома с замером по акции под дерево панорамные раздвижные с откосами

[url=https://okna-plastic-9.ru/]https://okna-plastic-9.ru/[/url] – выбрать окна онлайн с примеркой по фото с заменой советских окон на теплые с кэшбэком

[url=https://okna-plastic-3.ru/]окна пластиковые цена с установкой[/url] – прозрачная стоимость на пластиковые окна в Москве

[url=https://okna-plastic-8.ru/]https://okna-plastic-8.ru[/url] – заводские цены без посредников европейское оборудование сертификаты изготовление за 1 день

https://www.moskva-internet.ru – Посмотрите инструкции по настройке оборудования

топ провайдеров Москвы топ провайдеров Москвы – ознакомиться ежеквартальный список компаний Москвы с отзывами

moskva-internet.ru/ – Главный ресурс с актуальными новостями

http://www.moskva-internet.ru – Точная ссылка на главную страницу портала

http://moskva-internet.ru/ – Дополнительная ссылка на зеркало сайта

интернет по адресу в Москве проверить провайдеры рейтинг провайдеров интернета в Москве – проверить подключенные операторы связи в вашем районе с подключением

интернет 1000 мб с в Москве – установить комплексный бизнес-решения и бытовые услуги в столице с комплексным подключением под ключ

интернет казахстан – надежно настроить надежный доступ в интернет по всему городу

домашний интернет и тв Москва – выбрать объективный рейтинг провайдеров Москвы с высокоскоростным доступом

подключить домашний интернет в Москве по адресу – активировать ультрабыстрый гигабитный интернет в квартиру в Москве

дешевый интернет Москва – приобрести безлимитный интернет для дома с привязкой к адресу от подключенных компаний с гарантией

кабельный интернет – заказать оптоволоконный интернет-доступ от Казахтелеком рассчитать стоимость

казахтелеком интернет – срочно активировать оптоволоконный интернет-канал в Нур-Султане

казахтелеком интернет – просто провести скоростной выход в сеть с бесплатным монтажом

провести интернет в Москве – подобрать ежеквартальный рейтинг востребованных компаний с оценками

казахтелеком интернет астана – быстро запустить доступный интернет с гарантией качества

провести интернет в офис в Москве – заказать выгодный сетевой доступ в квартиру в столице от топовых операторов с настройкой

самый лучший провайдер интернета в Москве – установить мобильный домашний интернет в квартиру с гарантией

провести интернет в Москве – выбрать подробный топ востребованных компаний с тарифами

астана интернет – профессионально заказать современный выход в сеть в удобное время

интернет подключить – оценить проверенных телекоммуникационных компаний-поставщиков с тарифами

подключить интернет – изучить современный офисный доступ в сеть в Астане

Комплексное продвижение сайта с поддержкой на всех этапах <a href=

https://bence.net/seomaster12345

Компания предлагает широкий ассортимент дизельных генераторов, смотрите здесь <a href=

https://www.patreon.com/posts/nadezhnoe-s-ot-145042143

Продажа лицензионного ПО для касс и автоматизации бизнеса, полная информация по ссылке <a href=

https://followgrown.com/Posbazarmsk

Поставка и внедрение iiko с обучением персонала в Санкт-Петербурге, узнайте все детали <a href=

https://www.dostally.com/1765573016730056_65772