The Income Tax Department has set the Cost Inflation Index (CII) for the financial year 2025-26 at 376. This crucial index helps taxpayers determine long-term capital gains (LTCG) on asset sales by adjusting the original purchase cost for inflation. The announcement was made on July 1, 2025, and the new index will be effective from April 1, 2026.

Thank you for reading this post, don't forget to subscribe!Why is the CII important?

Long-term capital assets are typically recorded at their initial cost. Without adjustment, inflation can make the profit appear higher than it is when these assets are sold. The CII inflates the acquisition cost, which in turn reduces the taxable capital gain and the tax liability for the seller.

Special Considerations for House Property:

While recent tax rule changes (effective for transfers on or after July 23, 2024) have removed indexation benefits for most assets, there’s a key exception for house properties. If a house was acquired on or before July 22, 2024, and sold on or after July 23, 2024, homeowners (resident individuals and HUFs) have a choice:

- Old Rule: Pay LTCG tax at 20% with indexation.

- New Rule: Pay LTCG tax at a flat 12.5% without indexation.

For those choosing the old rule, the new CII of 376 will be essential in calculating the inflation-adjusted cost, potentially lowering their tax burden.

How to Use the CII:

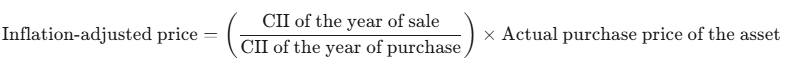

The formula to calculate the inflation-adjusted price is:

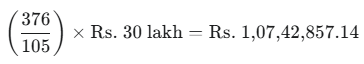

Example: If you bought a house in FY 2002-03 for Rs. 30 lakh, its inflation-adjusted cost for a sale in FY 2025-26 would be:

The base year for the CII is 2001-02, with an index value of 100. For assets acquired before this period, you can use the higher of the actual cost or the Fair Market Value (FMV) as of April 1, 2001, for indexation purposes.

This updated CII is a vital tool for taxpayers, helping them manage their tax liabilities fairly by reflecting the impact of inflation on long-term capital assets, especially in the context of evolving tax regulations.

Cost Inflation Index Table (2001-02 to 2025-26):

| Financial Year | Cost Inflation Index (CII) |

| 2001-02 (Base) | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

| 2021-22 | 317 |

| 2022-23 | 331 |

| 2023-24 | 348 |

| 2024-25 | 363 |

| 2025-26 | 376 |