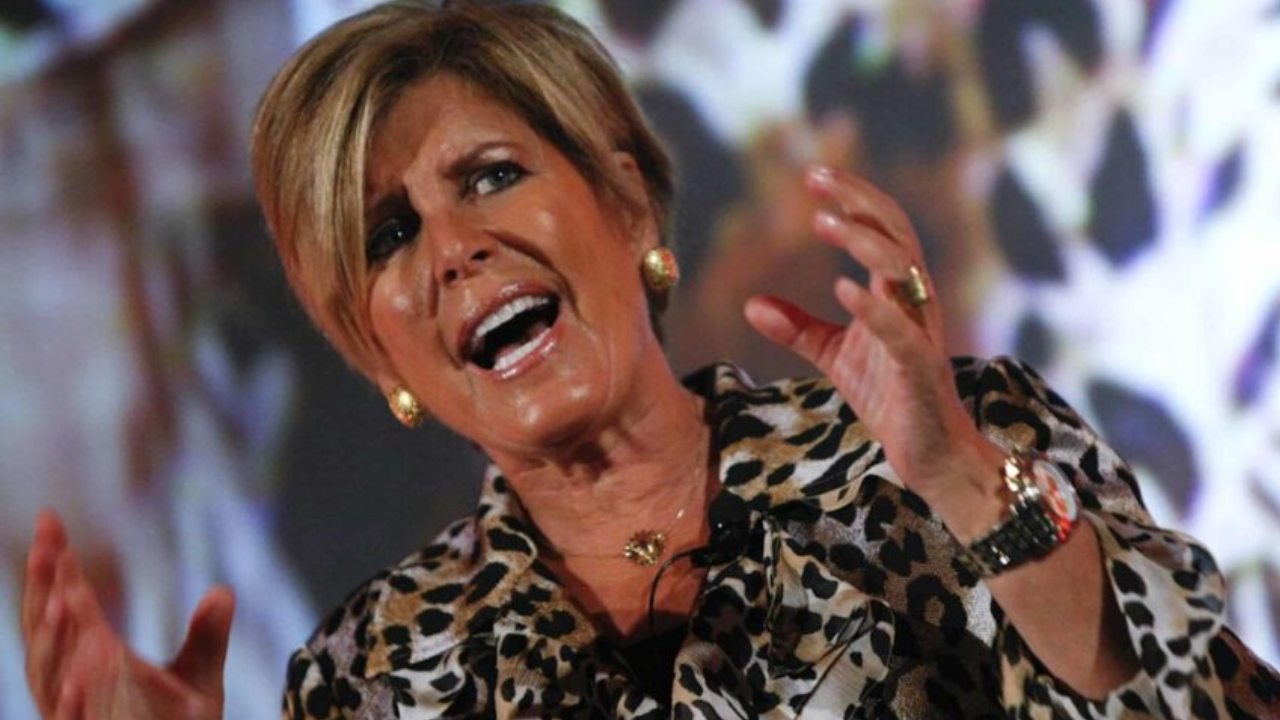

Finance guru Suze Orman offers clear, actionable strategies for individuals seeking to fortify their financial health and prepare for retirement. Her advice centers on a powerful combination of mindful spending, disciplined saving, and maximizing investment opportunities.

1: The Needs vs. Wants Mindset

Orman argues that the single biggest threat to financial stability is prioritizing desires over necessities. This common mistake can derail savings, especially as retirement approaches.

- The Six-Month Challenge: To correct this habit, Orman proposes a transformative challenge: for half a year, focus exclusively on purchasing needs.

- Defining the Difference:

- Needs: Fundamental, non-negotiable requirements (e.g., basic food, essential shelter, healthcare, essential clothing).

- Wants: Non-essential luxuries and desires (e.g., expensive upgrades, frequent dining out, high-end gadgets).

- The Result: By adopting this strict, frugal approach, individuals can dramatically improve their cash flow, leading to increased savings that can then be strategically allocated to family necessities and long-term goals.

2: The Power of Automated Savings

Building an essential financial safety net requires discipline, which Orman suggests automating.

- Set it and Forget it: Individuals should set up automated transfers to regularly divert a portion of every paycheck directly into a savings account.

- The Emergency Fund: This consistent habit is the most effective way to steadily build substantial savings and establish a crucial emergency fund, a safety net many Americans lack.

3: Maximize Retirement Match

Orman urges everyone to treat employer-matched contributions as “free money” that must not be left on the table.

- 401(k) Leverage: Individuals should maximize their contributions to their retirement plans, especially the 401(k), up to the percentage matched by their employer.

- The Return on Contribution: If an employer matches up to 6% of an employee’s salary, contributing that full 6% yields the most immediate and significant long-term growth.

- Example: An employee earning $75,000 who contributes 6% and receives a full match will see nearly $6,750 contributed to their retirement account annually, substantially accelerating wealth accumulation.

By adopting these core principles—prioritizing needs over wants, implementing automated savings, and maximizing the employer match—Americans can secure a much stronger foundation for their future and confidently approach the next stage of life.