Correct Your ITR Errors by December 31, 2025, or Face Serious Consequences!

Thank you for reading this post, don't forget to subscribe!

Did you spot a mistake in your Income Tax Return (ITR) for Assessment Year (AY) 2025-26? Whether it’s incorrect income, missed deductions, or outdated personal information, time is running out to fix it. The final deadline to file a revised or belated return for AY 2025-26 is December 31, 2025. Acting now can save you from income tax notices, hefty penalties, and potential legal action for misreporting or non-disclosure.

Why Timely Revision is Crucial

Common errors include using the wrong ITR form, overlooking foreign income or assets, or failing to claim legitimate deductions. Even a small detail like incorrect bank account information can delay your refund or trigger scrutiny from the tax authorities. By revising your return before the deadline, you ensure accuracy, prevent flags from the tax department, and avoid future complications.

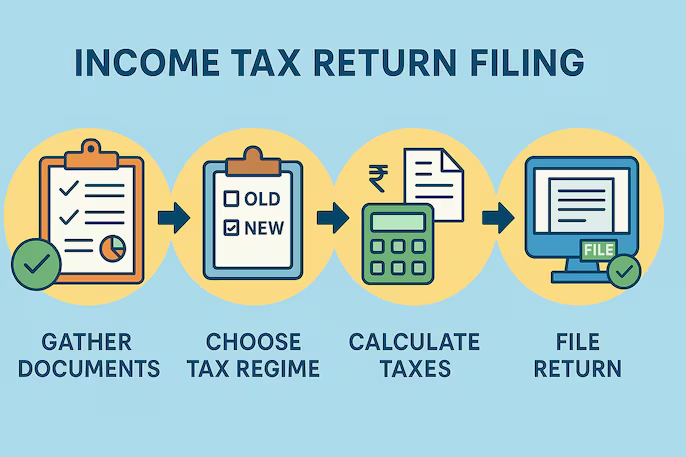

The Revision Process: What You Need to Know

- No Cost: There’s no fee for filing a revised return.

- Multiple Revisions: You can revise your ITR as many times as necessary within the December 31, 2025 deadline.

- Crucial Verification: After filing, your revised return must be verified within 30 days, either electronically or by sending a physical ITR-V form. An unverified return is considered invalid, potentially nullifying your corrections and exposing you to penalties or missed refund opportunities.

- Refund Impact: Already received your refund? You can still file a revised return to correct mistakes. Your refund won’t be impacted unless the revision reveals underreported income or additional tax dues. It’s always better to proactively correct your records than to wait for the Income Tax Department to issue a query.

Special Attention to Foreign Assets

Failure to report foreign assets, Employee Stock Option Plans (ESOPs) from foreign employers, or overseas income can attract severe penalties under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. While Budget 2024 offers some relief by exempting foreign movable assets worth under ₹20 lakh from penalty (in cases of bonafide mistake), non-disclosure still carries significant compliance risks. This is especially important for individuals working with multinational corporations or holding global investments. Ensure these are accurately reported and revise your return if any were missed.

Missed the Deadline? Consider an Updated Return (ITR-U)

If you miss the December 31, 2025 deadline for revised or belated returns, you have a last resort: filing an Updated Return (ITR-U) under Section 139(8A) of the Income Tax Act. This window is open for up to 48 months after the assessment year ends. However, this option is only available if it results in additional tax dues; it cannot be used to claim extra refunds or losses. Filing an ITR-U also comes with additional penalties on the tax payable, making timely revision the more prudent choice.

Don’t delay! Review your ITR and make any necessary corrections by December 31, 2025, to ensure compliance and peace of mind.