Suze Orman’s viral claim that retiring safely requires at least $5 million caused widespread alarm, but the math tells a very different story for the typical American household. You likely don’t need anywhere near that amount to retire comfortably.

The key to a secure retirement is not hitting an arbitrary figure, but developing a clear, personalized plan based on your actual spending, guaranteed income, and a sustainable withdrawal strategy.

Why Orman’s $5 Million Target Misses the Mark

While Orman cites legitimate concerns like longevity and inflation, her figure assumes a level of spending and risk that most retirees do not face.

| The Myth (Orman’s Claim) | The Reality (BLS Data & Analysis) |

| Assumes a luxury lifestyle and high spending. | The typical household aged 65+ spends about $65,000 annually. |

| Assumes investments must cover 100% of costs. | Social Security covers a substantial portion: the average retired couple receives over $45,000 annually. |

| Requires $\$5$ million in savings. | To sustain $65,000 spending (at a 3.5% withdrawal rate), you need roughly $1.7 million—a fraction of the $5 million target. |

Orman’s biggest flaw is ignoring guaranteed income sources like Social Security and pensions, which dramatically reduce the burden on personal savings.

How to Calculate Your Actual Savings Goal

Financial experts advise a personalized, backward-working approach. Follow these three steps to determine what you need:

1. Estimate Your Retirement Spending

- Calculate your expected annual expenses (housing, utilities, food, travel, medical).

- Pro Tip: Most people find their spending drops by 20% to 30% in retirement, especially after paying off the mortgage or eliminating commuting costs.

2. Subtract Your Guaranteed Income

- Tally up all reliable, non-portfolio income: Social Security, pensions, side hustles, etc.

- This difference is your Annual Income Gap—the amount your savings must generate.

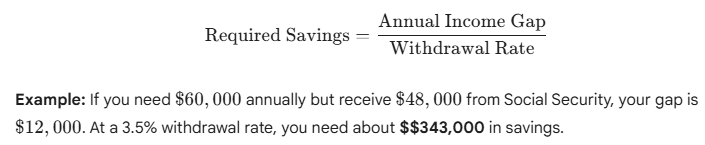

3. Apply a Withdrawal Rate

- Use a conservative rate, typically 3% to 4%, based on your risk tolerance and expected lifespan. The article uses 3.5%.

- Formula:

When a High Goal IS Justified

A seven-figure goal is realistic only for those facing maximum risk or expense:

- Early Retirement: Retiring before Social Security (pre-age 65) means covering years of expenses and private health insurance.

- High Cost of Living: Living in major metropolitan areas like San Francisco or New York City.

- Catastrophic Healthcare: Needing to cover years of long-term care or assisted living (which can cost $95,000 annually).

Bottom Line: Plan for Your Life, Not the Headline

The $5 million myth taps into financial anxieties about running out of money and healthcare bankruptcy. However, these risks are best managed through smart planning (sustainable withdrawal strategies, delaying Social Security, and purchasing appropriate insurance), not by over-saving millions “just in case.”

A comfortable retirement is built on realistic expectations: your spending patterns, your guaranteed income, and a sustainable investment strategy tailored to your life, not a viral, worst-case-scenario number.