TAX

Why One Income Is No Longer Enough: The Gurugram Husband’s Financial Strain

The recent viral story of a Gurugram-based software engineer has sparked a vital conversation …

Don’t Ignore Your AIS: Common Errors That Can Lead to an Income Tax Notice

An Annual Information Statement (AIS) is a statement containing a taxpayer’s financial information for …

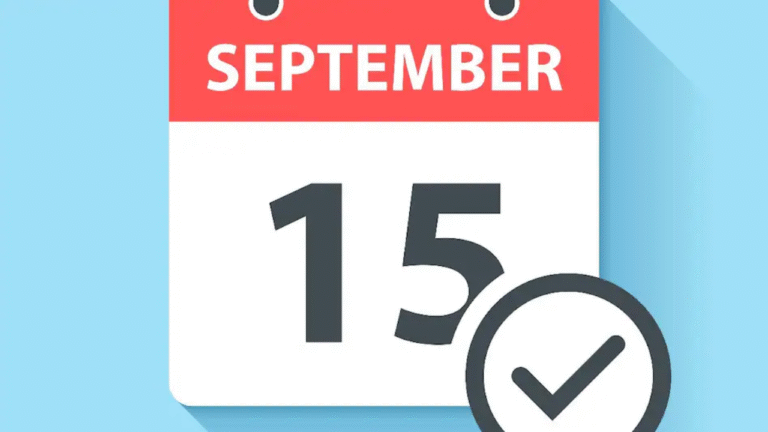

ITR Filing Deadline Nears: Your Last-Minute Checklist Before September 15

ITR Filing Deadline Nears: Your Last-Minute Checklist Before September 15 With the September 15 …