Income Tax

I-T Department Seeks to Cancel CA Licenses in ₹2,000 Crore Tax Evasion Scam

I-T Department Targets CAs in Massive Tax Evasion Scheme The Income Tax (I-T) Department’s …

ITR Deadline Looms: Taxpayers and CAs Urge CBDT for Extension

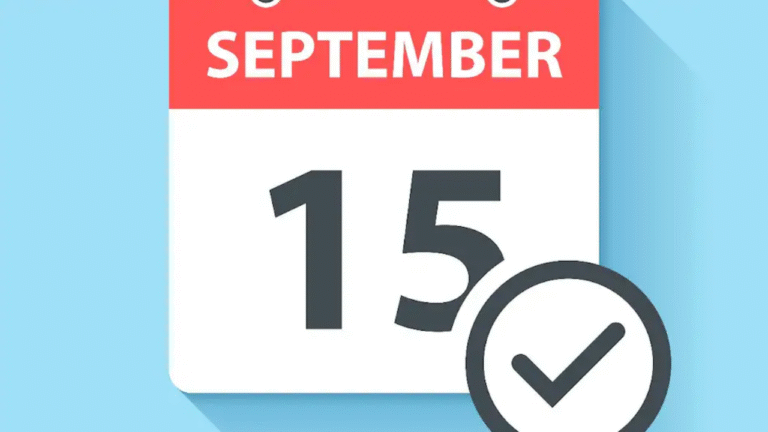

ITR filings for the financial year 2024-25 are lagging significantly as the September 15 …

Will the CBDT Blink? Taxpayers Await a Lifeline as September 15 Nears

Chartered accountants and business groups are sounding the alarm: with the September 15 deadline …