Tax assistant

Tax assistant

IndiGo Extends Suspension of Central Asia Flights Until Feb 11

NEW DELHI – Citing ongoing geopolitical tensions in the Middle East, IndiGo has announced …

ICC Denies Media Access to Bangladeshi Journalists for 2026 T20 World Cup

In a historic and controversial move, the International Cricket Council (ICC) has rejected the …

The Proposed Deal: A Massive ICE Conversion

The U.S. Department of Homeland Security (DHS) has officially notified local officials in Virginia …

Leaders Seek De-escalation After Second Fatal Federal Shooting in Minnesota

In a significant pivot from their recent public clashes, President Donald Trump and Governor …

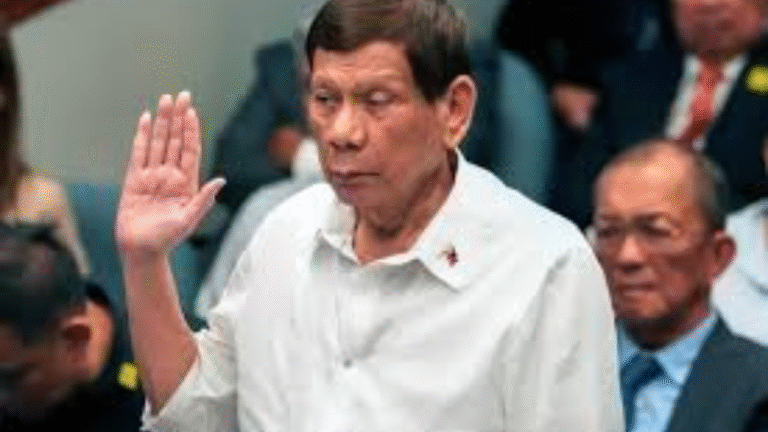

ICC Greenlights Trial for Rodrigo Duterte After Fitness Review

In a landmark decision issued today, January 26, 2026, the International Criminal Court (ICC) …