The new GST reforms are a massive boost for Manipur’s unique economy—from the highlands to the valleys!

Thank you for reading this post, don't forget to subscribe!The Power of 5% GST:

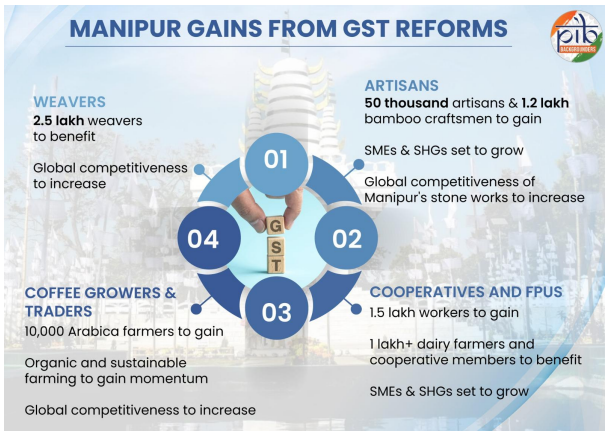

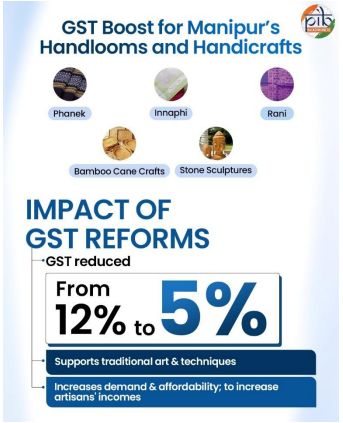

- Handlooms: Our beautiful Phanek and Innaphi textiles are now more affordable globally! 2.5 lakh weavers are set to benefit.

- Artisan Crafts: Bamboo crafts and stone carvings are getting cheaper for consumers. This supports 1.2 lakh artisans and boosts local SMEs!

- Coffee Growers: Packaged Arabica coffee gets a huge tax cut (from 18% to 5%), helping 10,000 farmers increase profits and global reach.

- Local Food: Processed foods like fermented bamboo shoots and pickles are more affordable, supporting 1.5 lakh workers and boosting demand.

These changes are designed to empower our local communities, preserve traditional livelihoods, and make Manipur’s products competitive everywhere. Let’s grow together.

Headline: GST Reforms 2025 to Drive Inclusive Economic Growth in Manipur: Handlooms, Coffee, and Agro-Industries Set for 5% Tax Rate

The new GST rate rationalization is a targeted measure to bolster Manipur’s economy, which is heavily reliant on small-scale industries, traditional crafts, and agro-based livelihoods. By significantly reducing the tax burden on key sectors, the reforms aim to enhance affordability, stimulate demand, and improve the global competitiveness of the state’s unique products.

Key Sectoral Impact:

- Handloom Textiles: The reduction of GST from 12% to 5% on handloom woven fabrics directly benefits approximately 2.5 lakh weavers, primarily women, by improving market access and consumer affordability.

- Coffee Cultivation: The packaged coffee GST rate has been slashed from 18% to 5%. This major relief is expected to boost profitability for over 10,000 Arabica coffee farmers in districts like Ukhrul and Senapati, encouraging sustainable practices and strengthening export potential.

- Artisan & Craft Economy: A uniform reduction from 12% to 5% on bamboo/cane furniture and stone carving products supports 1.2 lakh artisans and is projected to expand the reach of Self-Help Groups (SHGs) and Small and Medium Enterprises (SMEs).

These systemic changes are poised to empower local entrepreneurs, strengthen value chains in processed foods and dairy, and ensure the Northeastern states play a more robust role in India’s overall economic expansion.

Manipur’s Economic Catalyst: How the 2025 GST Reforms Will Transform Local Livelihoods

The recent GST reforms represent more than just tax adjustments; they are a strategic instrument for driving inclusive growth, particularly in states where the economy is deeply rooted in small, traditional enterprises. For Manipur, a state rich in indigenous crafts, handlooms, and high-value agricultural produce like Arabica coffee, these changes are poised to act as a significant economic catalyst.

The core of the reform involves rationalizing GST rates down to 5% for several crucial local sectors. This measure fundamentally addresses two challenges: it lowers input costs for small producers and enhances the final product’s affordability for the consumer, thereby stimulating both domestic and global demand. The impact is profound: from the 2.5 lakh handloom weavers and 1.2 lakh artisans gaining better market competitiveness to the 10,000 coffee growers seeing an increase in profitability, the reforms are strategically designed to empower regional communities and ensure the long-term preservation of Manipur’s traditional economic heritage.

Comments are closed.