The ₹15,512 crore Tata Capital Initial Public Offering (IPO), open from today until October 8, has potential investors raising concerns over the company’s low profit margins compared to its peers.

Thank you for reading this post, don't forget to subscribe!Managing Director and CEO Rajiv Sabharwal addressed this key issue, arguing that the company’s margins must be evaluated alongside its credit costs, which he claimed are “the least in the industry.”

The Cost of Funds and Credit Quality

Sabharwal explained that the cost of funds rose last year due to the merger with Tata Motors Finance, an acquisition that also grew the loan book by 40%. He noted that, excluding the acquired book, Tata Capital’s organic growth has been strong, exceeding 25% in recent years.

Crucially, he emphasized the company’s superior asset quality:

- Normalized Credit Cost: If the impact of the acquisition is separated, Tata Capital’s credit cost for FY25 would be 0.9% of the money lent.

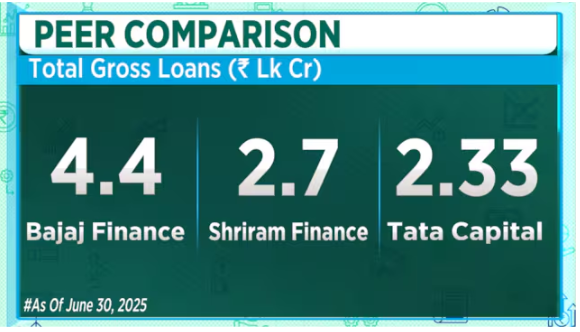

- Current Credit Cost: At 1.80% (April-June 2025), Tata Capital’s credit cost is already significantly lower than its peers, like Bajaj Finance (4.50%) and Shriram Finance (2.76%).

| Company | FY25 NIM | Credit Cost (Apr-Jun 2025) |

| Tata Capital | 5.2% | 1.80% |

| Bajaj Finance | 9.9% | 4.50% |

| Shriram Finance | 9.6% | 2.76% |

| Cholamandalam Inv. | 6.9% | 3.10% |

Key Growth Opportunities

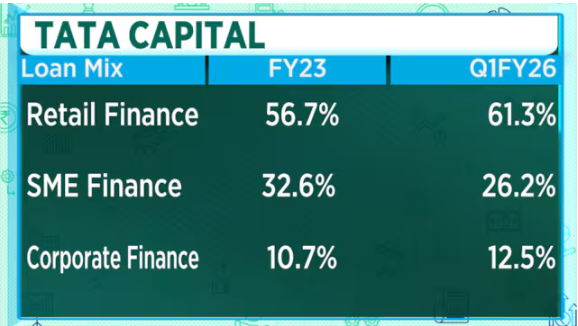

Sabharwal outlined two major growth drivers for the company:

- Lending to Small Businesses: This segment currently comprises 88% of the loan book and is growing quickly at 17−18%.

- Affordable Housing: This is the fastest-growing part of their housing portfolio, expanding at over 30% annually, positioning Tata Capital as a top player despite broader market challenges.