ITR filings for the financial year 2024-25 are lagging significantly as the September 15 deadline for non-audit cases looms. With only five days left, taxpayers and chartered accountants (CAs) are urgently appealing to the Central Board of Direct Taxes (CBDT) for an extension.

Thank you for reading this post, don't forget to subscribe!Why an Extension Is Needed

The slow filing rate—just 4.89 crore returns out of 13.35 crore registered users as of September 7—is attributed to several key issues:

- Late Release of Utilities: Tax experts point out that the ITR utility was released as late as August 14, giving taxpayers and professionals far less time than the usual four months to prepare.

- Technical Glitches: Persistent issues with the e-filing portal have created major bottlenecks, hindering the submission process for many.

- External Factors: Widespread floods in several states and the upcoming Navratri festival are cited as additional reasons for the delay, adding to the already heavy compliance workload.

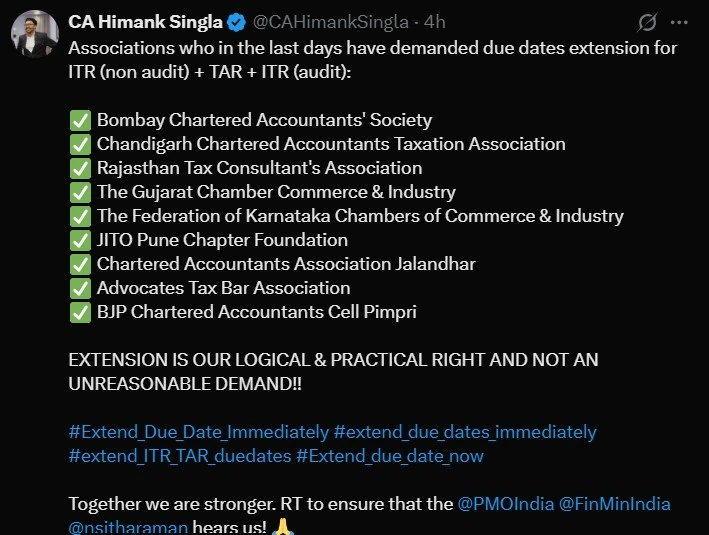

Organizations like the Federation of Karnataka Chambers of Commerce & Industry (FKCCI) and the Chartered Accountants Association, Surat (CAAS) have formally petitioned the CBDT, arguing that an extension is a “logical and practical right” rather than an unreasonable demand.

Proposed New Deadlines

To provide sufficient relief, tax advisory platforms like Fintax Pro have proposed a staggered extension plan:

- September 30: Non-audit ITRs

- October 31: Tax Audit Reports (TAR)

- November 30: Audit and transfer pricing cases

- December 31: ITRs with transfer pricing reports

These extensions, they argue, would allow professionals to ensure accuracy and full compliance.

Risks of Missing the Deadline

If the September 15 deadline is not extended, taxpayers who fail to file on time face penalties under the Income Tax Act:

- Late Fee: A fee of ₹1,000 to ₹5,000 may be imposed, depending on income levels.

- Interest Charges: Interest on unpaid taxes may be applied.

- Delayed Refunds: Any tax refunds will be processed only after the return is filed.

While the pressure for an extension mounts, experts caution taxpayers not to wait. The safest course of action is to file on time and avoid unnecessary penalties. The decision now rests with the CBDT and the Finance Ministry.