Tax season is here, and the Income Tax Department isn’t playing around. They’re using data analytics and AI to sniff out fake deduction claims, and if you’re caught, the consequences are severe: up to 7 years in jail and a 200% penalty!

Thank you for reading this post, don't forget to subscribe!The taxman has already flagged over Rs 1,045 crore in wrongful deductions, with 40,000 taxpayers using the ITR-U facility in just four months to reverse these false claims. They’re specifically scrutinizing common deductions like:

- House Rent Allowance (HRA) (Section 10(13A))

- Health Insurance Premiums (Section 80D)

- Donations to Political Parties and Charities (Sections 80G, 80GGC)

- Interest on Education Loans (Section 80E)

- Interest on Home Loans (Sections 80EE, 80EEB)

What Happens if You’re Caught?

Tax experts are clear: making false claims comes with hefty penalties.

- 200% penalty on the tax due for misreporting income under Section 270A.

- 24% annual interest under Sections 234B and 234C for unpaid or short-paid advance tax.

- Prosecution with rigorous imprisonment for up to 7 years under Section 276C in cases of willful tax evasion.

To combat this, the I-T department has ramped up disclosure requirements in the latest ITR forms. This includes detailed HRA calculations, insurer details for Section 80D, and loan sanction/account information for Sections 80E, 80EE, and 80EEA. Any discrepancies will likely trigger an automatic flag and a tax notice.

What Should You Do if You’ve Made a Mistake?

Don’t panic! The Income Tax Department offers a lifeline: ITR-U (Updated Return).

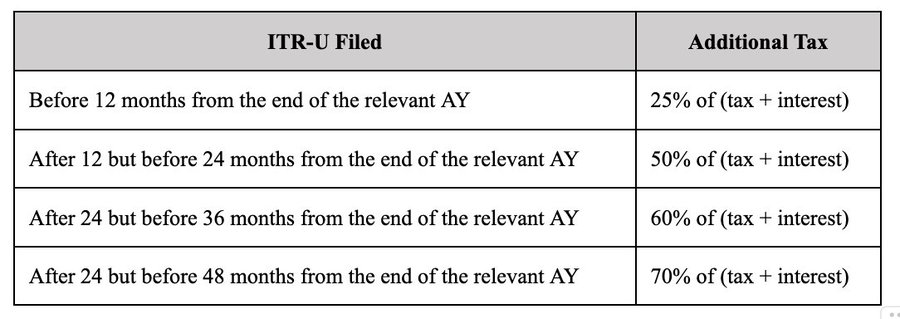

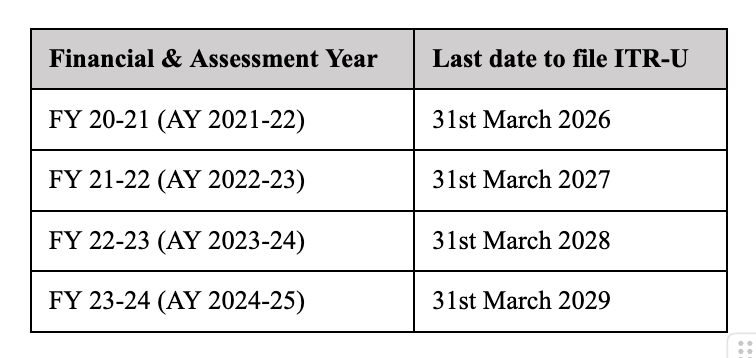

This facility allows you to correct errors, declare missed income, and withdraw any false claims you might have made. You have up to five years to file an ITR-U from the end of the relevant assessment year to rectify errors or voluntarily correct incorrect claims.

It’s always best to file your returns honestly and cross-check all details with your AIS (Annual Information Statement) and Form 26AS. And a word to the wise: avoid third-party refund agents who promise quick refunds based on dodgy deductions. They’re more likely to land you in hot water than save you money.

Stay honest, stay safe, and file smart this tax season!