Tax for Non-Resident Indians (NRIs) in India can feel complicated, but there’s a powerful way for them to pay zero tax on certain capital gains if they play their cards right. While most NRI income like rent, dividends, and interest is taxable in India, strategic reinvestments can unlock significant tax exemptions.

Thank you for reading this post, don't forget to subscribe!The NRI Tax Advantage: Sections 115F & 115C

Sections 115F and 115C of the Income Tax Act offer NRIs a golden opportunity to wipe out long-term capital gains tax on foreign exchange assets. This isn’t a loophole; it’s a legitimate, government-backed strategy for smart wealth planning.

Tax for Non-Resident Indians (NRIs) in India can feel complicated, but there’s a powerful way for them to pay zero tax on certain capital gains if they play their cards right. While most NRI income like rent, dividends, and interest is taxable in India, strategic reinvestments can unlock significant tax exemptions.

The NRI Tax Advantage: Sections 115F & 115C

Sections 115F and 115C of the Income Tax Act offer NRIs a golden opportunity to wipe out long-term capital gains tax on foreign exchange assets. This isn’t a loophole; it’s a legitimate, government-backed strategy for smart wealth planning.

Why Does This Matter?

India has a massive global diaspora, with over 1.58 crore NRIs. With NRIs holding an estimated $160 billion in deposits and sending over $129 billion in remittances in 2024, understanding Indian tax laws is crucial for managing cross-border assets effectively.

Who is an NRI for Tax Purposes?

You’re considered an NRI if:

- You were in India for less than 182 days during the financial year, OR

- You were in India for less than 60 days during the year and less than 365 days in the last four years.

Keep in mind, there are extended rules for Indian citizens or Persons of Indian Origin (PIOs) visiting India, or Indian citizens leaving for employment.

How NRI Incomes Are Taxed in India

Here’s a quick look at how different types of NRI income are generally taxed:

- Rent from Indian property: Taxable under “Income from House Property.” You can claim a 30% standard deduction plus interest on home loans.

- Interest on NRO account: Fully taxable.

- Interest on NRE/FCNR deposits: Exempt, as long as you maintain NRI status and the account is funded by foreign income.

- Dividends from Indian companies: Taxable as “Income from Other Sources,” with no threshold exemption.

- Short-term capital gains (STCG):

- On listed shares: Taxed at 20% under Section 111A.

- Others: Taxed at your slab rate.

- Long-term capital gains (LTCG): Generally 12.5% above ₹1.25 lakh, subject to the benefits of Section 115F.

- Business income from India: Taxable only if the business is controlled or set up in India.

- Gift received in India: Exempt if from relatives. Taxable if the value exceeds ₹50,000 and it’s from a non-relative.

The Zero-Tax Strategy: Section 115F

Section 115F offers full or proportional exemption from LTCG tax for NRIs who:

- Sell a foreign exchange asset. This is any asset bought with convertible foreign exchange.

- Reinvest the net sale proceeds into specified assets within six months.

What can you reinvest in? Eligible reinvestment options include:

- Equity shares of Indian companies

- Debentures of Indian public companies

- Public deposits with Indian companies

- Government securities

Important: This specific exemption doesn’t cover reinvestment in mutual funds, real estate, or gold.

The Catch: A 3-Year Lock-in You must hold the newly acquired assets for at least three years. If you sell them earlier, the exempted gain becomes taxable in the year of the sale.

How the Exemption is Calculated:

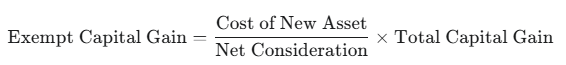

The exempt capital gain is calculated using this formula:

Tax for Non-Resident Indians (NRIs) in India can feel complicated, but there’s a powerful way for them to pay zero tax on certain capital gains if they play their cards right. While most NRI income like rent, dividends, and interest is taxable in India, strategic reinvestments can unlock significant tax exemptions.

The NRI Tax Advantage: Sections 115F & 115C

Sections 115F and 115C of the Income Tax Act offer NRIs a golden opportunity to wipe out long-term capital gains tax on foreign exchange assets. This isn’t a loophole; it’s a legitimate, government-backed strategy for smart wealth planning.

Why Does This Matter?

India has a massive global diaspora, with over 1.58 crore NRIs. With NRIs holding an estimated $160 billion in deposits and sending over $129 billion in remittances in 2024, understanding Indian tax laws is crucial for managing cross-border assets effectively.

Who is an NRI for Tax Purposes?

You’re considered an NRI if:

- You were in India for less than 182 days during the financial year, OR

- You were in India for less than 60 days during the year and less than 365 days in the last four years.

Keep in mind, there are extended rules for Indian citizens or Persons of Indian Origin (PIOs) visiting India, or Indian citizens leaving for employment.

How NRI Incomes Are Taxed in India

Here’s a quick look at how different types of NRI income are generally taxed:

- Rent from Indian property: Taxable under “Income from House Property.” You can claim a 30% standard deduction plus interest on home loans.

- Interest on NRO account: Fully taxable.

- Interest on NRE/FCNR deposits: Exempt, as long as you maintain NRI status and the account is funded by foreign income.

- Dividends from Indian companies: Taxable as “Income from Other Sources,” with no threshold exemption.

- Short-term capital gains (STCG):

- On listed shares: Taxed at 20% under Section 111A.

- Others: Taxed at your slab rate.

- Long-term capital gains (LTCG): Generally 12.5% above ₹1.25 lakh, subject to the benefits of Section 115F.

- Business income from India: Taxable only if the business is controlled or set up in India.

- Gift received in India: Exempt if from relatives. Taxable if the value exceeds ₹50,000 and it’s from a non-relative.

The Zero-Tax Strategy: Section 115F

Section 115F offers full or proportional exemption from LTCG tax for NRIs who:

- Sell a foreign exchange asset. This is any asset bought with convertible foreign exchange.

- Reinvest the net sale proceeds into specified assets within six months.

What can you reinvest in? Eligible reinvestment options include:

- Equity shares of Indian companies

- Debentures of Indian public companies

- Public deposits with Indian companies

- Government securities

Important: This specific exemption doesn’t cover reinvestment in mutual funds, real estate, or gold.

The Catch: A 3-Year Lock-in You must hold the newly acquired assets for at least three years. If you sell them earlier, the exempted gain becomes taxable in the year of the sale.

How the Exemption is Calculated:

The exempt capital gain is calculated using this formula:Exempt Capital Gain=Net ConsiderationCost of New Asset×Total Capital Gain

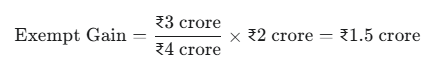

Let’s look at an example:

Imagine you sell India-listed equity shares (a foreign exchange asset) with a net sale value of ₹4 crore, which originally cost you ₹2 crore. Your capital gain is ₹2 crore.

If you reinvest ₹3 crore into eligible assets:

- This means ₹1.5 crore of your gain is exempt. You’d only pay tax on the remaining ₹50 lakh. At a 12.5% LTCG rate, that’s a tax saving of ₹18.75 lakh!

4 Key Things to Remember for Section 115F Compliance

- Strict 6-Month Deadline: Reinvest the entire net sale proceeds (not just the gain) into eligible assets within six months of the sale.

- Invest Only in Specified Assets: Stick to shares, debentures, deposits, and government securities.

- Hold New Assets for 3 Years: Don’t sell or convert your reinvested assets for at least three years, or your exempted gain becomes taxable.

- Maintain NRI Status & Fund Traceability: Ensure your reinvestment uses foreign exchange funds and you retain your NRI status. Keep clear bank and FIRC records.

Beyond 115F: Other Capital Gains Exemptions

NRIs can also benefit from other common capital gains exemptions:

- Section 54 (Residential Property): Reinvest LTCG from selling a house into buying/constructing another house in India.

- Section 54EC (Specified Bonds): Invest LTCG from land/building sales into specific bonds (e.g., REC, NHAI) within six months, up to ₹50 lakh.

- Section 54F (Other Assets to Residential Property): Reinvest net consideration from selling any long-term asset (except a house) into buying/constructing a residential property.

Navigating DTAAs for Even More Benefits

For NRIs residing in countries with a Double Taxation Avoidance Agreement (DTAA) with India, there might be further tax benefits. DTAAs prevent you from paying tax on the same income twice. For instance, capital gains from mutual fund units might be taxable only in your country of residence if your DTAA has a beneficial clause. To claim DTAA benefits, you’ll need a valid Tax Residency Certificate (TRC) from your country of residence.

The Bottom Line

NRI taxation might seem complex, but smart planning can unlock significant advantages. Provisions like Section 115F allow NRIs to legally save substantial amounts of tax, efficiently reinvest in India, and maintain their wealth across borders. This isn’t tax evasion; it’s smart, lawful tax planning endorsed by the Income Tax Act.

Have questions about how these rules apply to your specific situation? It’s always best to consult a tax expert!